Klaviyo Leads the 2024 Valuation Race; the Growth Endurance Calculation; and Using the Toothbrush Test to Build RCS Apps

In business as in life: grow to live and live to grow

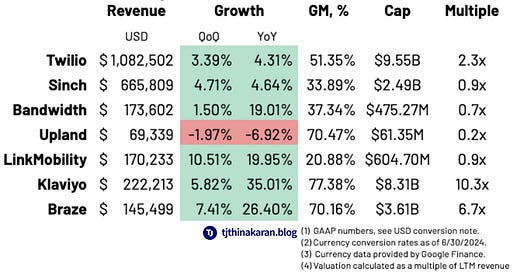

Klaviyo Leads the 2024 Valuation Race

At over ten times its last twelve months’ (LTM) revenue, Klaviyo leads the valuation race. Its $8.31 billion valuation puts it in the same zip code as Twilio’s $9.55 billion. Along with Braze, Klaviyo proves that responsible growth continues to drive valuations. Responsible growth includes net dollar retention above 100%, low or manageable debt loads, and a self-sustaining customer base that doesn’t rely on new customers to preserve revenue levels.

Disclaimer: This is not stock advice. Everything about the messaging business interests me, including asset pricing. Use your judgment to invest your money.

Responsible growth values the repeat customer. Take Braze for instance. If 96% of your revenue comes from subscriptions and your net revenue retention (NRR or NDR) exceeds 100%, it shows an efficiency in customer retention that doesn’t require reinvesting every incremental dollar just to maintain the current book of business. Responsible growth, then, is also about GTM efficiency.

This is a good place to wrap up the Q2 earnings coverage. In about ten weeks, we’ll see how Q3 went. Sign up to get play-by-play updates delivered to your inbox.

The Growth Endurance Calculation

Growth endurance measures a company’s ability to sustain high revenue growth as it scales. It’s calculated by dividing the current year’s growth by the previous year’s. For example, if a company’s revenue grew by 80% last year and 70% this year, its growth endurance would be 87.5%, because 80% is 87.5% of $80%. That means the company retained nearly 90% of its growth momentum. So while a 13% drop in growth might be concerning—maybe even a reason to run for the hills—growth endurance asks you to pause and look a bit deeper.

(For context, 80% growth endurance is considered strong for a public company.)

A slowdown in growth is normal as a company scales. We’ve seen it with Salesforce and Twilio. The larger a company gets, the harder it becomes to double, triple, or quadruple revenue year after year. In fact, doubling revenue over $100M ARR is so rare that BVP calls these companies “centaurs,” noting they are seven times rarer than unicorn companies.

Even Braze had 100% growth endurance in 2019 and 2020, but that dropped to 63% in 2021. Like many public companies, Braze stopped reporting growth endurance. However, for private SaaS and CPaaS companies, it remains a valuable metric, especially when absolute dollar growth looks lackluster.

What Does the Metric Mean?

Several factors drive growth endurance: market size, product-market fit, go-to-market strategy, account expansion, and launching new products. It is easiest to calculate when the revenue is recurring like ARR versus a usage model. For companies like Salesforce and Twilio, that are a combination of multiple businesses, and M&A activity can impact the predictability of the revenue outlook.

For a brilliant discussion on growth endurance, see the OnlyCFO’s newsletter about AppFolio.

As companies scale, maintaining high growth gets tougher due to market saturation, competition, and complexity. Growth endurance helps gauge how sustainable that growth is. Modest growth is fine—so long as it doesn’t decay.

This metric matters because it shows if a company can sustain growth as it scales. For public cloud companies, 80% is solid. For private ones, 70% is good.

Finally

To use a running analogy, it’s not just about how fast you’re running; it’s about how long you can keep up the pace without stumbling. It’s not about doing a seven-minute mile; it’s whether you can sustain that pace for the next five.

Using the Toothbrush Test to Build RCS Features

I started my plea to invest aggressively in RCS with thirteen rapid-fire questions to assess your RCS readiness. Some of you shared that you had your boss’s boss Slack you with those questions seeking answers. Sorry, not sorry. The goal of the exercise is to show the enormity of the task and the need to act now. But with everything big, you have to start small, prioritize what to build, and iterate with pace. The toothbrush test is one way to prioritize what to build next. It prizes features that are low risk to build, high in their utility, and something that will be used multiple times a day.

I’ve said this before, for RCS, the delivery receipt is that killer app that passes the toothbrush test. From “The RCS Killer App”:

Once it has won over the geeks and early adopters, new technology needs to win the heart of the everyday user. You do that by solving a problem begging to be solved or improving a solution clamoring to be improved. For Rich Communication Services or RCS, that is the confirmation of a delivered text message.

Even as a first-principle, the delivery receipt (and its sibling, read receipt), is high in utility. Again from “Are You Investing Enough in RCS”:

As a first principle, messaging will endure as long as the human need for connection exists. As a second-order desire, the need to know that the message has reached its destination (delivery receipts) and that the message has been heard (read receipts) will not go away either.

Finally

Learning to say “no” and “not now” are the must-have skills for a product leader. So while you may be under pressure to implement drag-and-drop carousels, message expiry, and buttons, let’s crawl, walk, run. Start with implementing read receipts.

Thank you for reading, and have a great week!

TJ