Q3 CPaaS Earnings Review in One Table and Four Charts

There were no major surprises from Q3 earnings. The march toward profitability and responsible growth consumed all the companies, and they delivered. As expected, Kaylera bid goodbye, and we saw Klaviyo make its public market debut.

But First

LinkMobility announced that it would be postponing its Q3 earnings release by three weeks. It also announced divestiture from the Message Broadcast business. The delay is likely a timing issue. The agreement probably came down to the wire, and, given the rules, the company has to report it as a disinvested business as of Q3 2023.

On an organic basis, there shouldn’t be any surprises: LinkMobility has shown conservatism in prior quarters, and that shouldn’t change. As for the divestiture, it flows with the overall theme of efficiency LinkMobility has followed. As a near-neutral, principal-preserving activity, the deal frees up sizable capital for future investments more aligned with its strategy.

A disdain for shackles of the past and a first principles approach to today’s reality is always a good investment call.

Cross-Sell to Grow

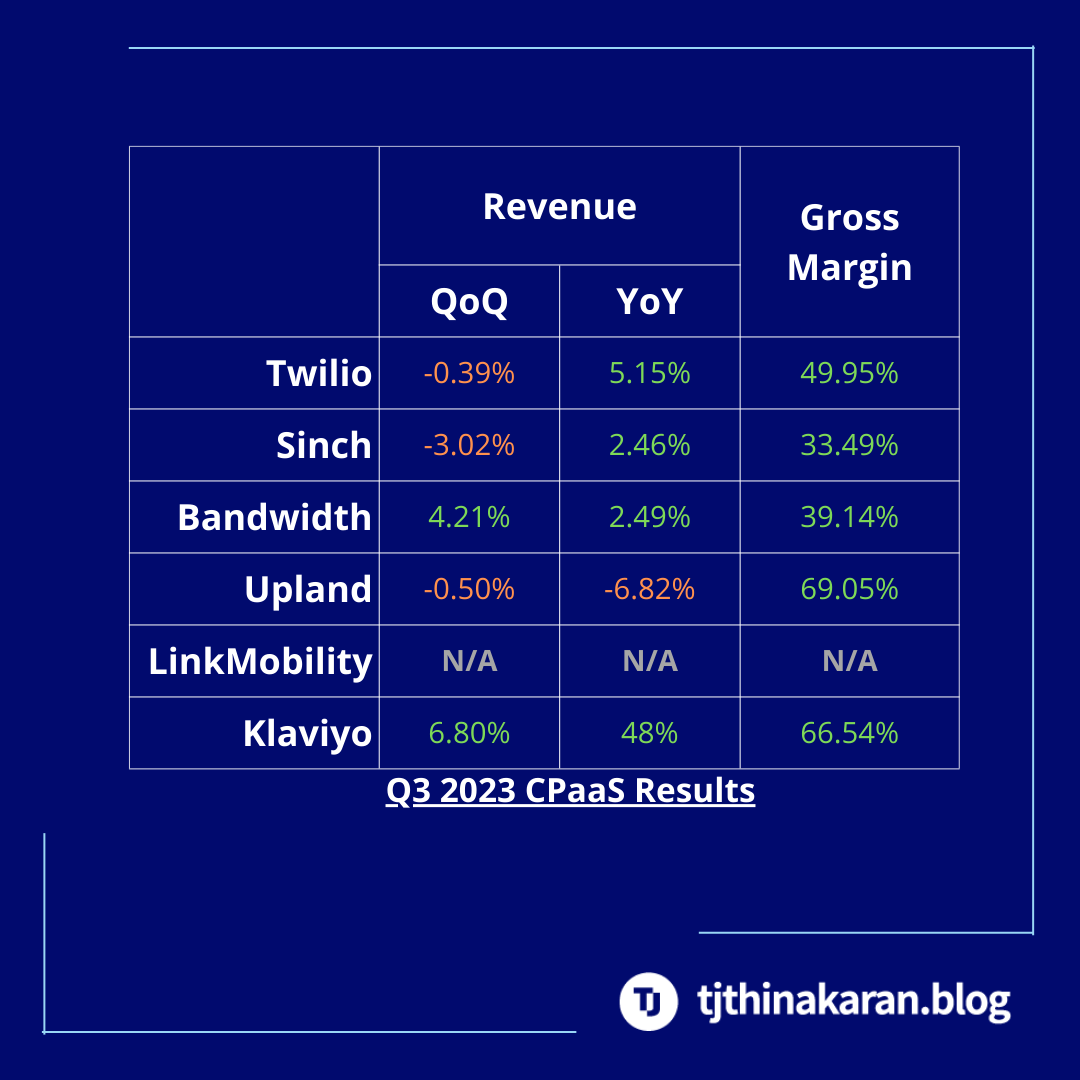

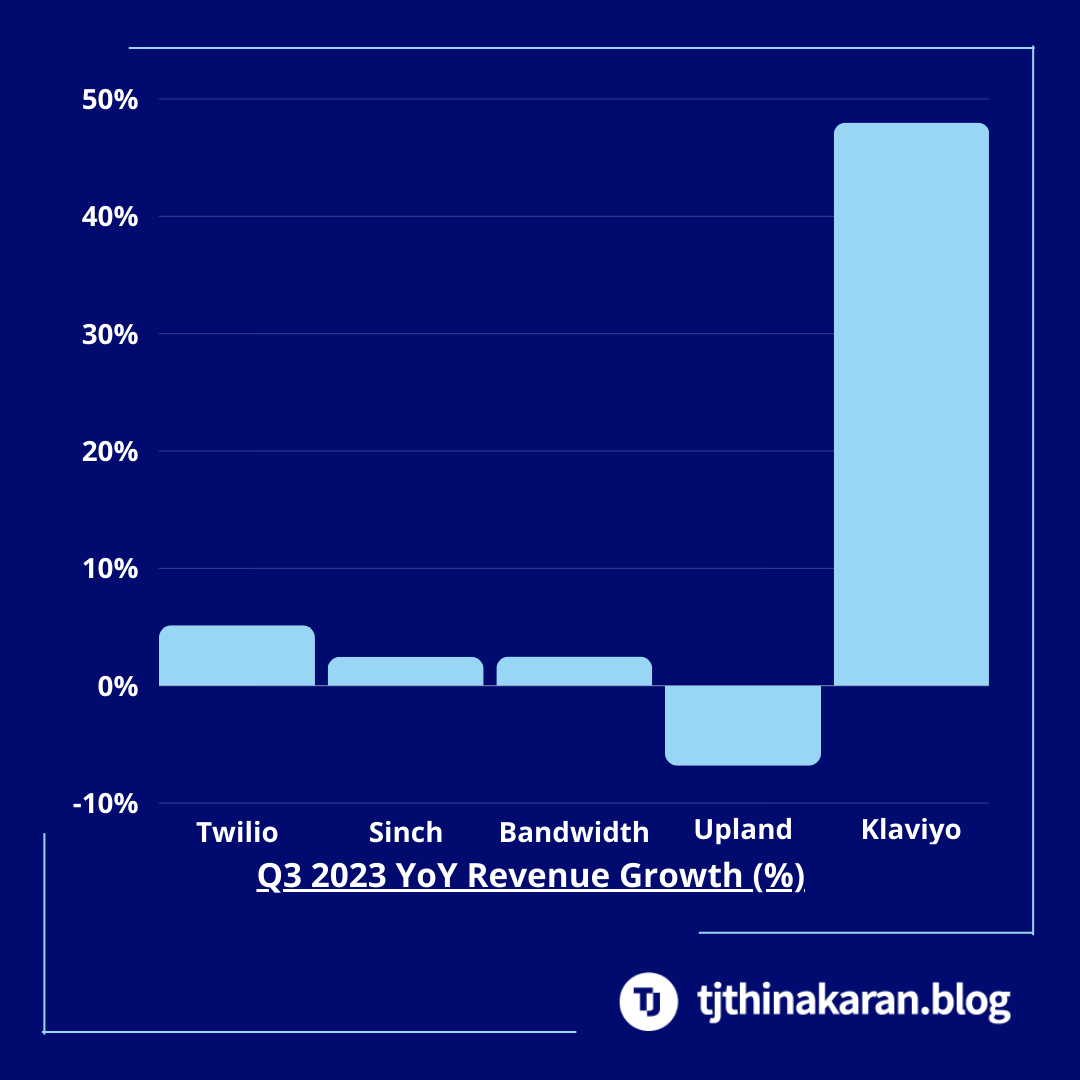

With the exception of Klaviyo, the “horizontal” CPaaS companies found growth harder to come by. In addition to a tough macroeconomic environment, they are dealing with a discerning customer base that’s happy with good enough and more cost conscious than before. This is showing up in pragmatic buying decisions. The good news is that Twilio, Sinch, and Bandwidth are seeing early signs that cross-selling works.

Very much like the enterprise customer, Klaviyo reports that the SMB/mid-market user too is fatigued with the proliferation of tools and looking to consolidate (on their platform, of course).

Not only is Klaviyo benefiting from a resilient SMB market, but it also had significant mid-market success with 89% YoY growth on customers with $50K or more ARR.

Klaviyo’s SMS growth is opportunistic with new SMS routes built into Ireland. It is also aware of the higher COGS from SMS and willing to walk away from deals that don’t fit its UoE.

Klaviyo also declared its ambition to get into the enterprise. How that challenges its UoE and how it handles pass-thru fees should be instructive. Anyone selling to the enterprise at some point passes on (hence the term “pass-thru”) carrier surcharges to the customer. Klaviyo has shown no inclination to do so.

The cross-selling push mirrors a larger trend in the SaaS industry. As Tomasz Tunguz observes, “No longer do best-of-breed programs dominate; now it’s all about best-for-budget.” He goes on to say that gone are the days of individualized workflows tailored toward the end user who ended up taxing the IT organization. “Now conditions have changed,” Tunguz says. “Buyers are favoring efficiency over design and cost over craft.”

The Valuation Reflection

The last earnings season of the year is also a good time to talk about valuations. Even if at times the stock market may seem untethered from reality, it is still a strong valuation signal for private companies.

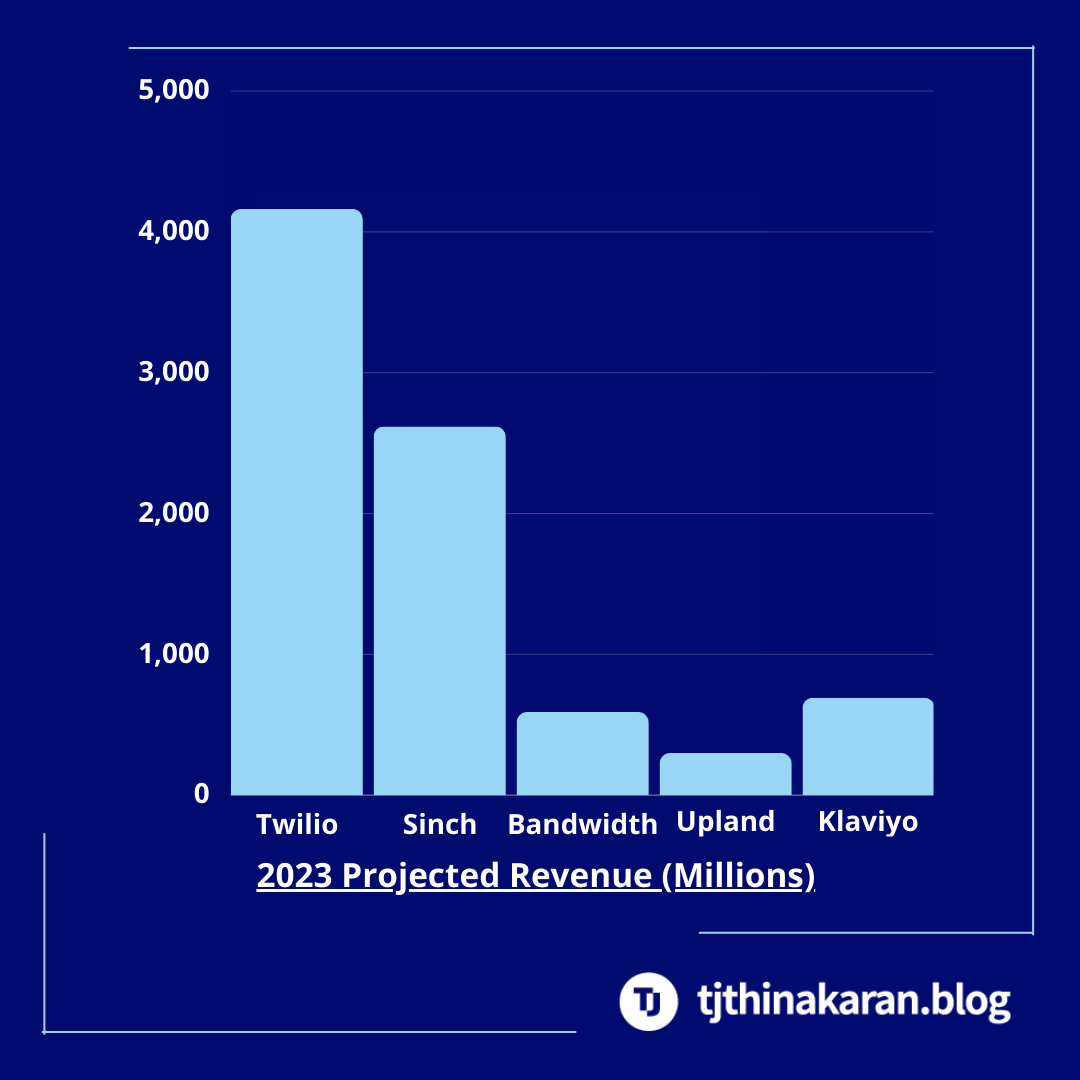

As a multiple of revenue, Klaviyo (9.5x) and Twilio (2.5x) lead the pack, with the others either trading at par or at a discount on revenue.

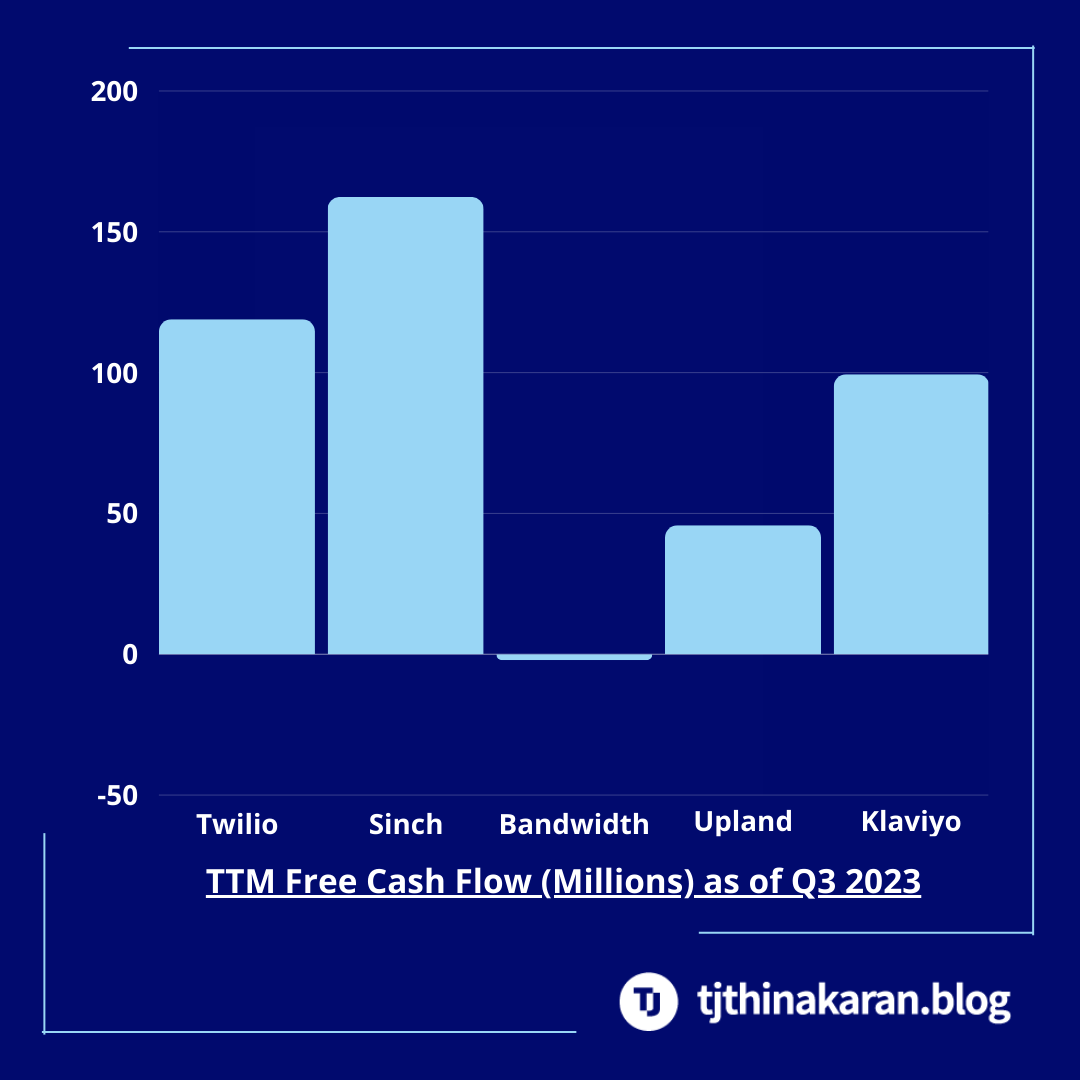

Valuation is an involved discussion, but based on the simple metrics tracked, it looks like both of them are getting high marks for revenue growth, stable (and high) gross margins, and profitability.

As a “vertical” CPaaS, Klaviyo has “Yes, And”-ed its way to solving the customer’s problem. Not only that, it has benefited from the preferential relationship (a.k.a. cooperative interoperability) with Shopify and is using that ecosystem growth to get into mid-market, international, and eventually the enterprise.

Twilio is the industry bellwether. With over 300K customers paying it over $4B/year to send texts, calls, and emails, it is number one—and by a wide margin. With size comes different growth challenges. Not only do big bets have to move the needle significantly (at ~$400M RR, Twilio Data & Applications is only 10% of revenue), but you also risk being commoditized out of the very markets you created. How it navigates these challenges in 2024 will be exciting to watch.

Finally

Overall, one has to be optimistic about 2024. Yes, in 2022 everyone got a shellacking, making 2023 a prove-you-can-be-profitable cleanup year. Next year will be the first year with a de-risked YoY comparison. That combined with seasonal swells like the US presidential elections means the entire industry should have a good year of new business.

Thank you for reading, and have a good week!

TJ